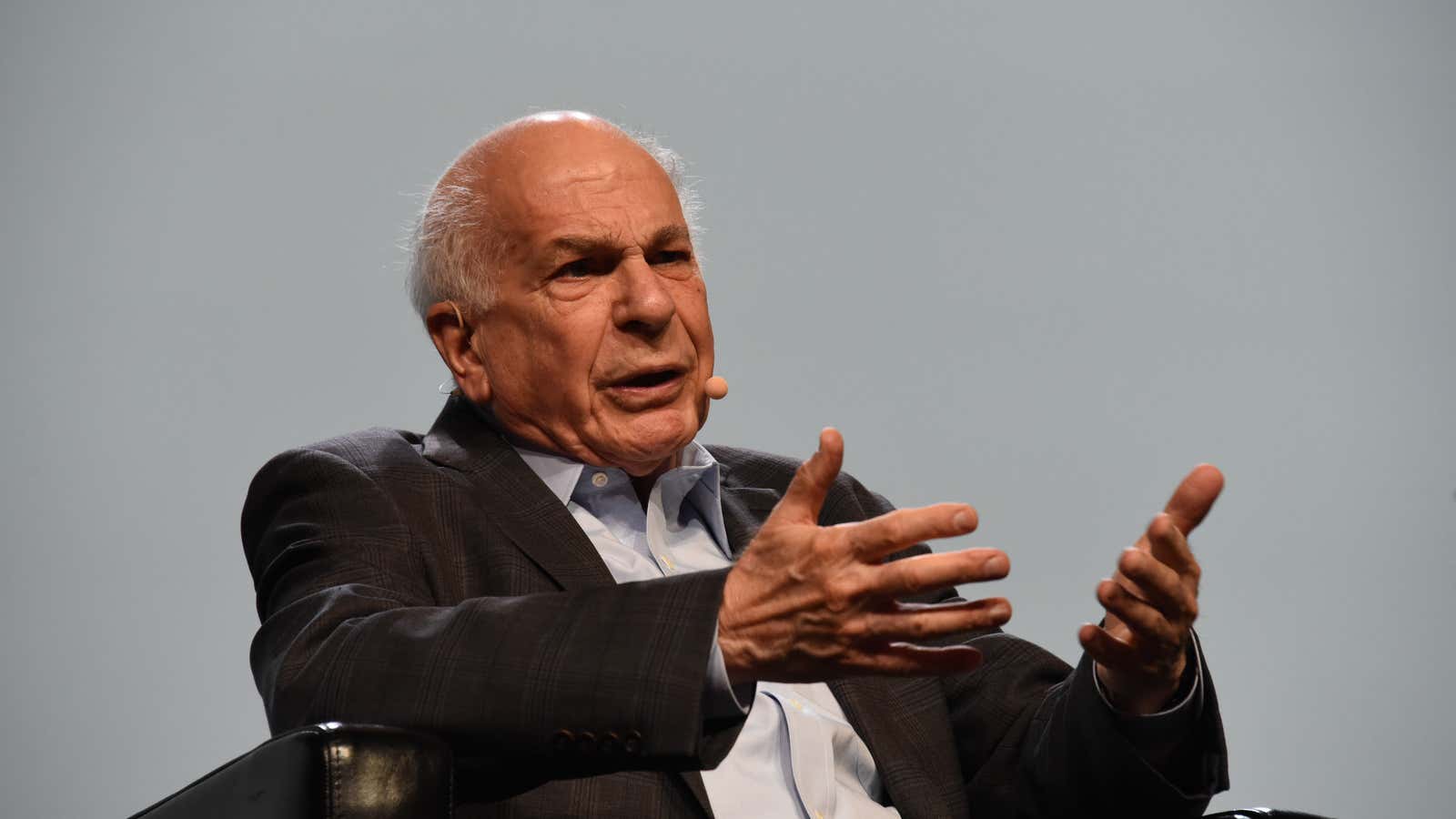

Regret is the biggest danger to financial health, according to Daniel Kahneman, a Nobel Prize-winning psychologist and author of the book, “Thinking, Fast and Slow.”

Kahneman spoke about his strategy for “regret-proof” investing at a recent Morningstar conference in Chicago. He and his colleague, Amos Tversky, developed the concept of loss aversion—the fact that losses hurt more than gains feel good. Kahneman and Tversky proved that humans don’t deal with uncertainty by carefully and rationally examining available information. Instead, real people use a host of mental shortcuts mixed with emotional reactions to make decisions.

The solution requires two portfolios

Kahneman extended this idea and created a “regret minimization” strategy while working with a team that did what he described as “financial advising for very wealthy people” at Guggenheim Partners. Kahneman’s view is that investment planning must strike a balance between wealth maximization and regret.

This requires understanding the investor. The optimal strategy for someone that is prone to regret and the optimal strategy for somebody that is not prone to regret are “really not the same,” he says.

For most people, the best investment strategy is to have a plan for when things go wrong and stick to it. This is easier said than done because, while it is possible to think through the possibilities, it is more difficult to imagine what it feels like when they actually happen. Kahneman’s insight was to plan for “the possibility of regret, including the possibility of them wanting to change their mind.”

“We had people try to imagine various scenarios, in general, bad scenarios,” Kahneman explained. “The question was, at what point do you think that you would want to bail out? That you would want to change your mind?”

Kahneman would get investors to think through how much of their fortune they were prepared to lose—10%, 20%, 30%? The idea was to then get people to imagine what it would feel like and, therefore, what they might be inclined to do in the moment. Most people—even the very wealthy—do not want to have a large portion of their fortune at risk and tend to pick a number around 10%.

The solution the team came up with was to design two portfolios, one risky and one safer, based on the “regret propensity” for each individual investor. The two portfolios are then managed and reported separately. This establishes a psychological distance between the two and allows the investor to feel safer, even though, in reality, they are both part of the same portfolio.

Usually, one of the portfolios is always doing better than market. This fact alone means that investors are less likely to panic, feel regret, and to want to change their minds when something does go wrong. According to Kahneman, even remembering that you actively imagined about how it would feel to have the value of your investments plunge is valuable.